In a world increasingly focused on sustainability, transparency, and accountability, the European Union (EU) has taken a significant step forward with the introduction of the Corporate Sustainability Reporting Directive (CSRD).

This new directive marks a pivotal moment in the EU’s efforts to promote corporate transparency and sustainability, aiming to align reporting standards and enhance the quality and comparability of sustainability disclosures across member states.

Let’s delve into what the EU CSRD entails and its implications for businesses, stakeholders and corporate travel programmes.

What is the CSRD?

The CSRD is European Union (EU) legislation, effective from 5 January 2023, requires EU businesses – including qualifying EU subsidiaries of non-EU companies – to disclose their environmental and social impacts, and how their environmental, social and governance (ESG) actions affect their business.

All CSRD disclosures must be publicly available, and the CSRD mandates third-party auditing of all disclosures for accuracy and completeness. It will impact over 50,000 companies, demanding stricter sustainability reporting inclusive of business travel activities.

The basics of the CSRD

The Corporate Sustainability Reporting Directive (CSRD);

- Aims to provide stakeholders with more transparency around their sustainability and encourage improvement

- Replaces the previous Non-Financial Reporting Directive (NFRD) – involving 12,000 companies

- Affects companies that have: <250 employees, and/or; <€50m in turnover, and/or; <€25m in total assets*

- Requires companies to report on their environmental, social and governance (ESG) performance, set emissions targets and update on their progress, and

- Makes sustainability a mandatory element of managed travel programmes.

*See criteria below

Which companies must comply with the CSRD?

By 2028, all of the following organisations, or undertakings, need to comply with the CSRD:

Listed undertakings

These include any companies listed on an EU-regulated market exchange—except for listed ‘micro undertakings’ that fail to meet two of the following three criteria on consecutive balance sheet dates:

- at least EUR 450,000 in total assets

- at least EUR 900,000 in net turnover (revenue)

- at least 10 employees (average) throughout the year

EU-based large undertakings, listed or not

These include any listed or non-listed companies that meet two of the following three criteria on any two consecutive balance sheet dates:

- at least EUR 25 million in total assets

- at least EUR 50 million in net turnover

- at least 250 employees (average) during the year.

“Third-country” undertakings

These include non-EU parent companies, with annual EU revenues of at least EUR 150 million in the most recent two years, and also own:

- a large EU-based undertaking, or

- an EU-based subsidiary with securities listed on an EU-regulated market exchange, or

- an EU branch office with at least EUR 40 million in net turnover.

The above includes recently updated thresholds of the EU Accounting Directive for determining the size category of a company.

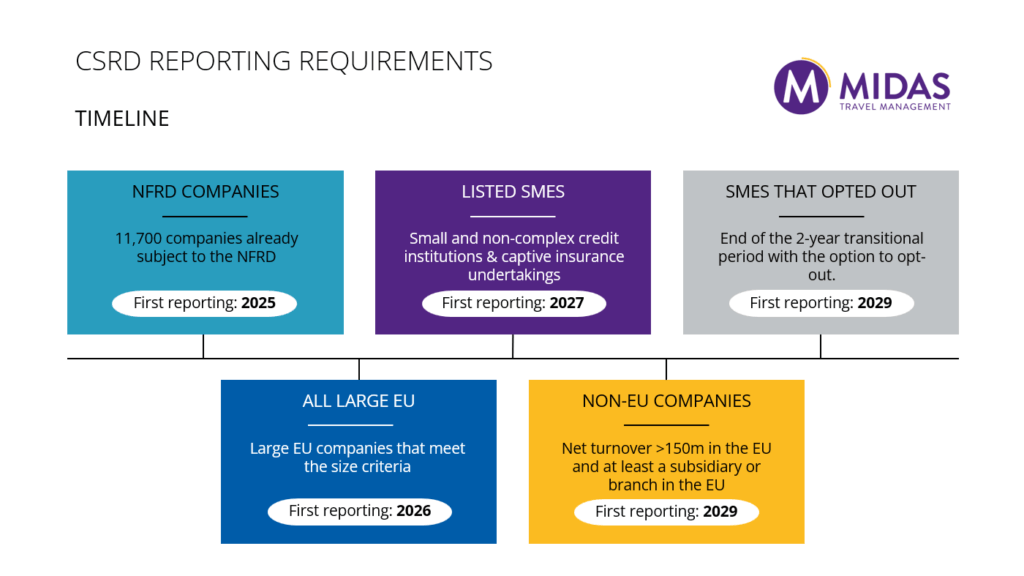

What is the timeline for CSRD compliance?

When will SME’s need to report?

Listed SMEs are mandated to report on the calendar year 2027, using data from the financial year 2026. However, SMEs have the option to postpone reporting for two years under the CSRD. Their compliance requirement is thus deferred to 2029, necessitating reporting for the financial year 2028.

Penalties for noncompliance

EU member states will require investigative and compliance entities to impose effective, proportionate and dissuasive penalties. Individual states will determine CSRD noncompliance penalties based on relevant state laws.

Companies will need to gather and consolidate large amounts of data to comply with the CSRD. Businesses can prepare for the changes by implementing a strong ESG data foundation which will assist in future CSRD audits.

How will CSRD affect your corporate travel programme?

As the CSRD is now legislation within EU law, businesses will need to educate themselves, and fulfil any associated reporting requirements. It is a great opportunity to counsel and educate the business on sustainable travel. In short, you will need to;

- Collect sustainability data that is compliant with the required metrics, and takes into account different system methodologies

- Ensure travel policies are accountable and meeting ESG targets

- Engage with stakeholders to align business objectives and company processes with sustainability goals

- Take advantage of your travel management companies’ sustainability resources.

Conclusion

The EU Corporate Sustainability Reporting Directive represents a significant milestone in the EU’s efforts to promote sustainable and responsible business practices. By harmonising reporting standards, enhancing transparency, and promoting digitalisation, the CSRD aims to empower businesses and stakeholders to address sustainability challenges and drive positive societal and environmental impact.

As companies adapt to the new reporting requirements, they have an opportunity to demonstrate leadership, build trust, and contribute to a more sustainable future.

MIDAS Travel is working closely with clients to build sustainable business travel programmes that support company objectives. It may be that you qualify for CRSD, you plan to voluntarily submit your reporting, or you just want to be CSRD ready. We can also help with net zero strategies, B-Corp certification, global C02 reporting and carbon offsetting projects.

Our dedicated ESG team are on hand to discuss your requirements or any questions you might have around the topic of CSRD. Please feel free to reach out.

USEFUL LINKS

- Corporate sustainability reporting – European Commission

- Sustainable Business Travel – MIDAS Travel Website

- An easy guide to business travel sustainability terminology – MIDAS Travel Blog

2 responses